Great calls

I’ve gotten an exceptionally high number of predictions right over the last two years since I started posting publicly. I put more emphasis on measuring macro-economics faster (LDEI, more on that at the end) and less on hot topics and micro-economics than most. I always…

Post FOMC meeting comments

Yesterday’s FOMC meeting was a combination of dovish and hawkish elements, but overall, the meeting was more dovish than I expected because Jerome Powell sounded dovish in the press conference. Nevertheless, Treasury yields rose as I expected (about 6bps) and I continue to think they…

The Fed isn’t as dovish as markets think

Three things have come together (somehow it is always three that make people feel certain) to give the impression that a September rate cut is a done deal; priced at an 88% chance in the Fed funds futures market. They are the weak July jobs…

Powell’s speech found the middle

Jerome Powell gave a much-awaited speech at the Kansas City Fed symposium at Jackson Hole this morning. Because of rising/hotter economic data, and a hawkish tone to the Fed lately, I thought he would lean hawkishly. He didn’t, but he wasn’t dovish either. Overall, the…

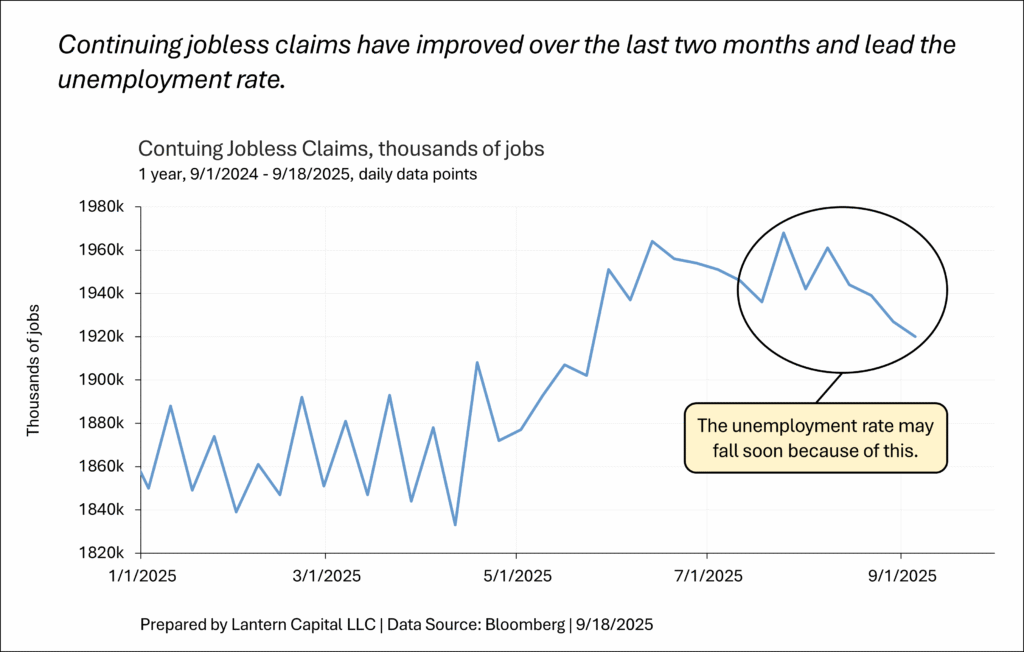

Treasury yields will likely rise until weak data become prominent again

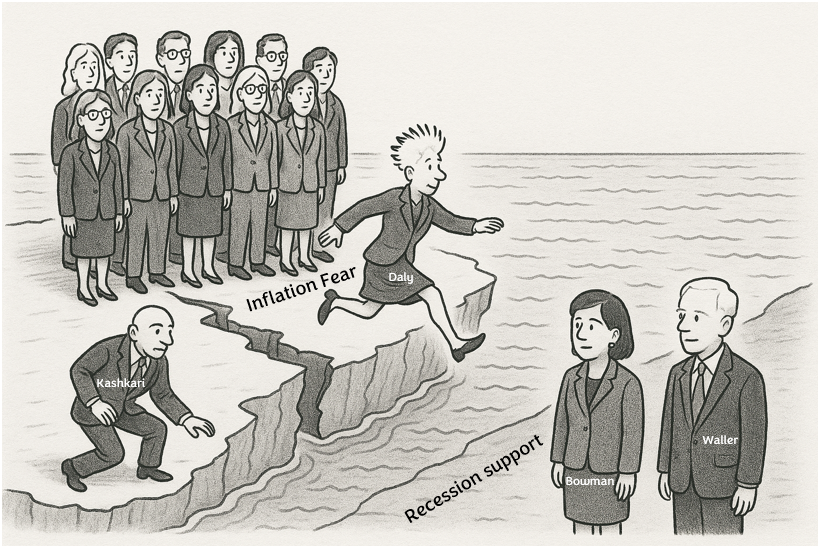

After the July payrolls report was released on August 1st, dovishness was in the air as regional Fed bank presidents Mary Daly and Neel Kashkari leapt to support the idea of near-term cuts because the labor market had weakened to a recessionary level (see chart…

Kashkari makes four

I wrote in last Friday’s LDEI update regarding the large downward revisions for non-farm payrolls, From this data, I expect more FOMC members to defect to Waller and Bowman’s dovish camp. And within a few days it happened. San Francisco Fed President Mary Daly made…

The Fed gave half an inch

After the last FOMC meeting, I wrote, “Powell didn’t give an inch”, referring to his avoidance of acknowledging economic weakness. In this meeting, there were some acknowledgements of economic weakness (half an inch, let’s say), but Powell did his best to be dismissive of them…

Five reasons to expect some softening from the Fed tomorrow

Last month, with economic data weakening quickly and Federal Reserve Governor Christopher Waller lobbying for a cut, I expected the Fed to cut rates at the FOMC meeting this week. But upon the strong payroll report on July 3rd, I wrote in my semi-weekly LDEI…

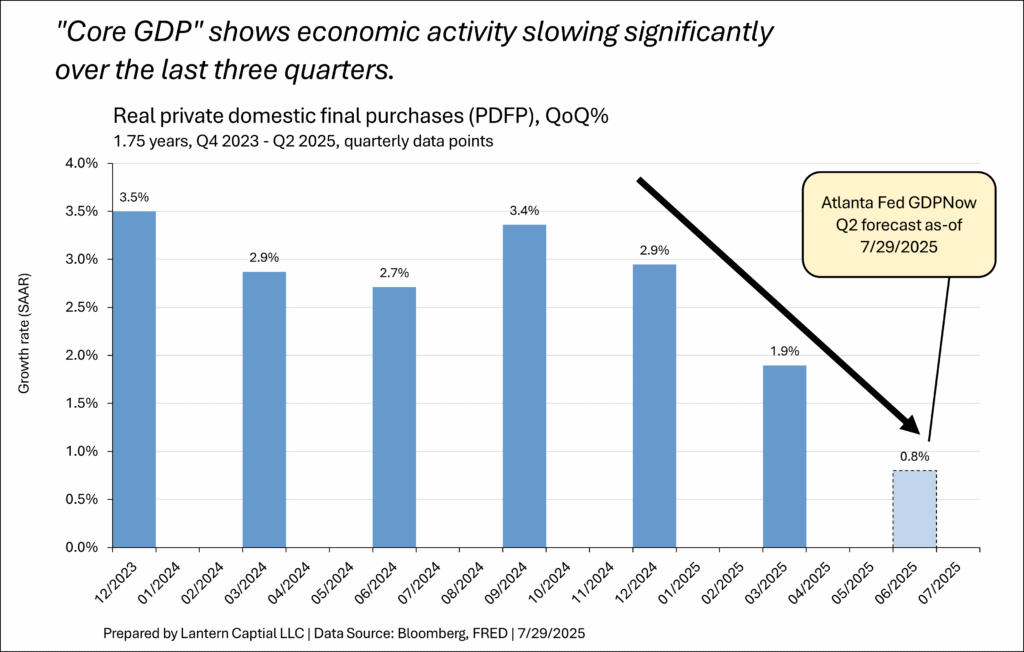

Don’t fall for the Q2 growth mirage

Stock bulls have something of a mantra now, “the recession is cancelled” from forecasts of GDP to rise significantly in Q2, tariffs coming down, and the Fed’s characterization of the economy as “solid.” These three pillars have reinforced each other to create an optimistic narrative…

The US Dollar is fine

News stories abounded in the last two days reporting that the US Dollar (DXY index) had the worst first half since 1973. See examples below: Financial Times: Bloomberg: The New York Times: The Wall Street Journal: Also, stories from the New York Post, The Guardian,…