Post FOMC meeting comments

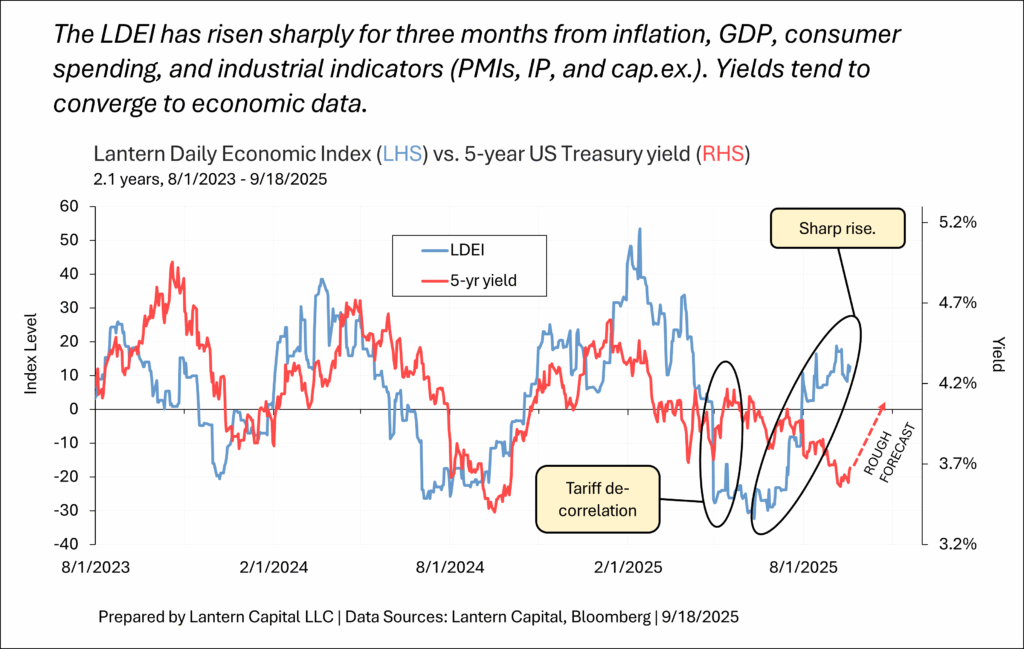

Yesterday’s FOMC meeting was a combination of dovish and hawkish elements, but overall, the meeting was more dovish than I expected because Jerome Powell sounded dovish in the press conference. Nevertheless, Treasury yields rose as I expected (about 6bps) and I continue to think they will rise a lot more to meet improving economic data since mid-June (chart below).

The Fed remains bifurcated, with 10 members expecting two or more cuts through the end of 2025 and nine members expecting one or fewer cuts (seven members are expecting no cuts and two are expecting one cut.) Median expectations in the SEP forecast for the Fed funds rate fell 25 basis points for the ends of 2025, 2026, and 2027 since the last meeting. This is about the same that the expectation in the bond market changed since the last meeting (27bps1). Call it a “mark-to-market” adjustment.

The bond market is extrapolating more economic weakness than the Fed is. Fed funds futures are priced for Fed funds to be 44 basis points lower than what the Fed expects at the end of next year (3.375% versus 2.93%). Should the labor market improve, there is a significant risk of higher rates.

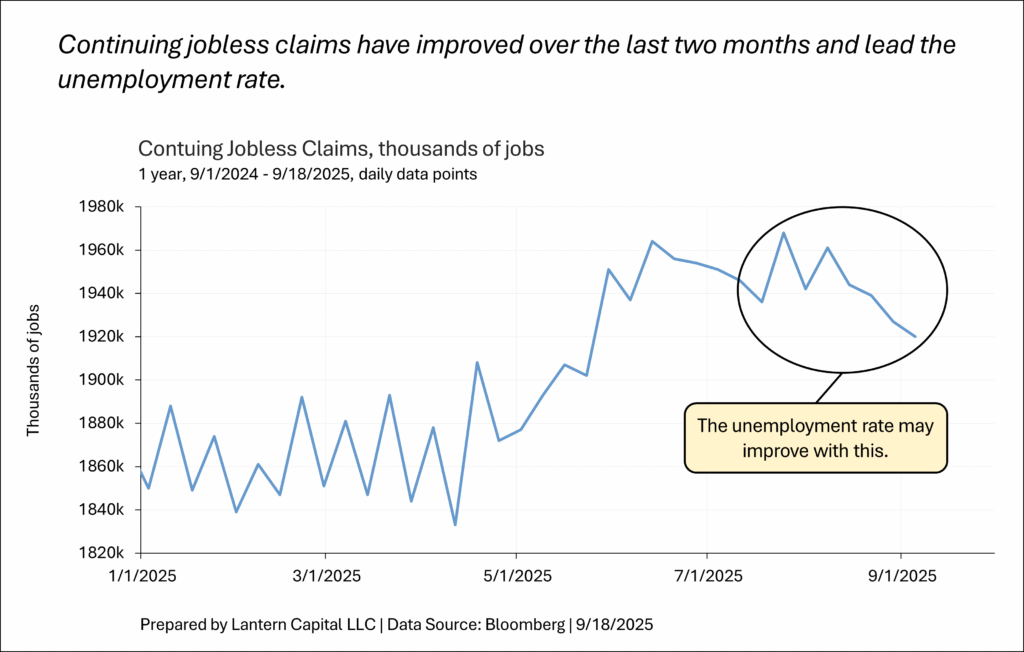

Today’s jobless claims report is a hint that it could. Last Thursday showed a large spike upwards in initial jobless claims which, along with lower payrolls and the unemployment rate up, helped solidify the story of an imminent recession for the doves. But that spike reversed this week. Initial claims fell 33k after rising 28k last week. Continuing jobless claims, which lead the unemployment rate, have been improving for nearly two months suggesting the unemployment rate may improve. More broadly, because overall economic data are rising, I expect them to eventually influence the labor market positively too.

1Measured from Bloomberg’s World Interest Rate Probability forecast for December 2026.