Kashkari makes four

I wrote in last Friday’s LDEI update regarding the large downward revisions for non-farm payrolls,

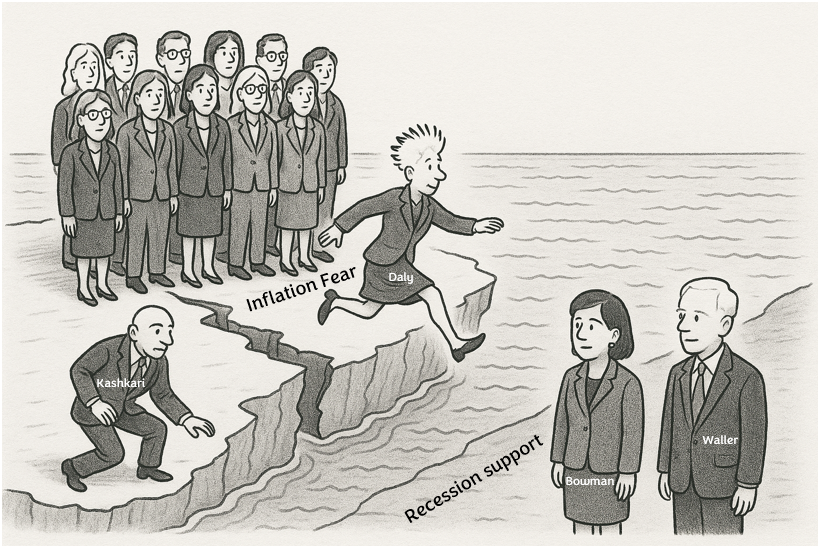

From this data, I expect more FOMC members to defect to Waller and Bowman’s dovish camp.

And within a few days it happened. San Francisco Fed President Mary Daly made dovish comments in an interview with Reuters on Monday and Minneapolis Fed President Neel Kashkari emphasized Daly’s narrative in a CNBC interview this morning that ‘there isn’t enough time to wait for clarity on tariff inflation to cut rates’. Relevant quotes from the Mary Daly interview below,

“I was willing to wait another cycle, but I can’t wait forever,” Daly said of the Fed’s decision last week to leave short-term borrowing costs in their 4.25%-4.50% range rather than cut them, as a couple of her colleagues wanted and as President Donald Trump has demanded.

“We of course could do fewer than two (rate cuts) if inflation picks up and spills over or if the labor market springs back,” Daly said. But “I think the more likely thing is that we might have to do more than two…we also should be prepared in my judgment to do more if the labor market looks to be entering that period of weakness and we still haven’t seen spillovers to inflation.

…there is “evidence after piece of evidence” that the labor market is softening quite a bit compared to last year. “I would see further softening as an unwelcome result,” she said. “I’m comfortable with the decision we made in July, but I am increasingly less comfortable with making that decision again and again.”

At the same time, she said, there’s no evidence that tariff-driven price increases are seeping more broadly into inflation, and if the Fed waits long enough to be certain it won’t — a process that could take six months or a year, she said – the Fed will “for sure” be too late to move.

And Neel Kashkari picked up on Daly’s ‘don’t have enough time to wait’ narrative this morning,

Well, there’s two categories of data that I’m focused on. There’s a bunch of data that I know and I’ve got confidence in and there’s data that I don’t know and we’re not going to know for a while. The data that I think we know is that the economy is slowing. Housing services inflation is gently declining, non-housing services inflation is coming down, wage growth is coming down, we’ve seen the jobs number, and consumer spending is cooling. All of that suggest the real underlying economy is slowing. I’ve got confidence that is happening. The part that I don’t have confidence yet is what are the ultimate effects of tariffs going to be on inflation and what I’m realizing is we may not know the answer to that for quarters or a year or more. And that tells me, as one policy maker, I need to start leaning more on the data that I’ve got confidence in; the economy is slowing. And that means in the near term, it may become appropriate to start adjusting the Federal Funds rate.

The FOMC’s shift from Chairman Jerome Powell’s stoic determination to not mention weakness in the economy at last Wednesday’s FOMC press conference to overt concern about the economy is abrupt. Neel Kashakri had been outspokenly hawkish until this morning. But there’s nothing new about any of this. Nearly half of recessions since 1950 (45%) have a stagflationary element towards the beginning of them (1954, 1958, 1975, 1990, and 2008) because inflation often lags and is mis-timed to the business cycle. They are always awkward for the Fed — I remember March through June of 2008 quite well. The Fed ultimately cuts rates through heightened inflation because the real economy takes precedence. Daly’s idea of ‘inflation is uncertain, but we don’t have time to find out’ will likely be adopted by more FOMC members moving forward. Jerome Powell will make a speech at the Jackson Hole Fed conference later this month (21-23), and I expect him to make a pivot towards easing then. I also expect Treasury yields will continue to ratchet lower as the Fed gets more dovish and further evidence of the recessionary economy reveals itself.