The Fed isn’t as dovish as markets think

Three things have come together (somehow it is always three that make people feel certain) to give the impression that a September rate cut is a done deal; priced at an 88% chance in the Fed funds futures market. They are the weak July jobs report, Jerome Powell’s Jackson Hole speech, and the attempted firing of Lisa Cook which leads markets to think the Fed will be more structurally dovish (the reason the 2-year fell on Tuesday and Wednesday). CNBC journalist Jeff Cox wrote an article on Monday with the title, “Markets are sure the Fed will cut in September, but the path from there is much murkier”, but added towards the end of the article that, “Despite the market pricing, Morgan Stanley sees just a 50% probability for a September reduction.” After Powell’s speech last Friday, Anna Wong, chief economist at Bloomberg Economics wrote,

Markets took Federal Reserve Chair Jerome Powell’s Jackson Hole speech as a green light for a September rate cut in September – we disagree. His characterization of labor-market conditions fell well short of signaling the need for urgent action, and revisions in the Fed’s statement of longer-run goals also tilted hawkish. Powell’s vague description of labor-market cooling suggests a lack of commitment and a weak consensus on the FOMC around a September rate cut, which would dissolve quickly should August data come in stronger. We still see the odds of a cut at slightly above even, rather than the near-certainty markets have priced in.

I agree with them both. A 50% chance is more appropriate for the data in-hand, the Fed’s rhetoric, and the near-term forecast of economic data. Consider these points:

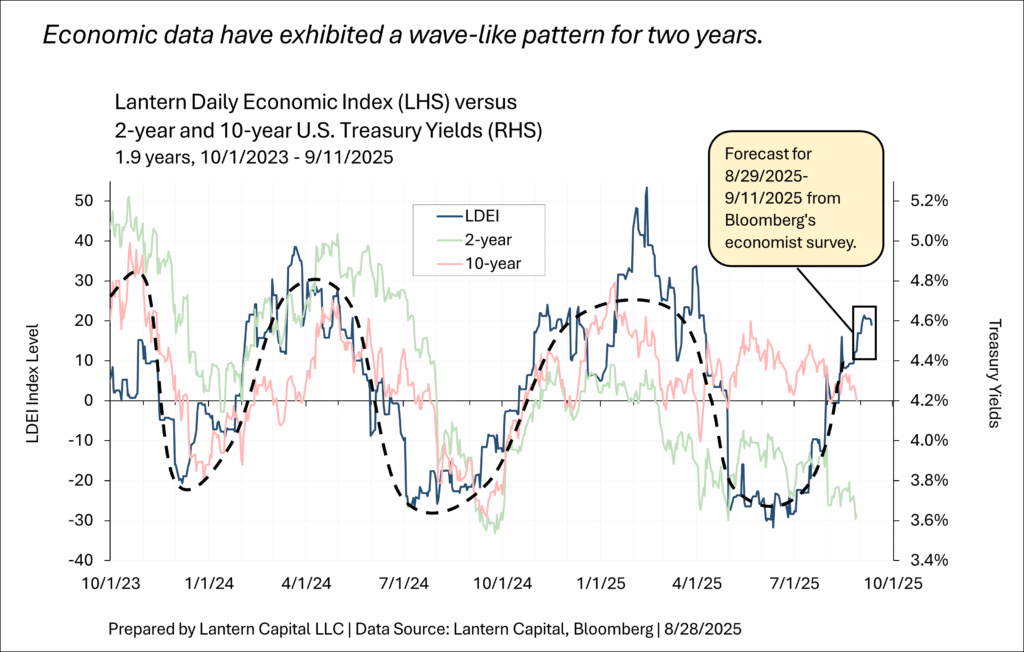

1. Economic data has improved substantially for two months and looks to improve more. The Fed is statutorily focused on the labor market, but, in practice, they care about the whole economy; the “totality of the data” as they’ve coined. Since 6/11/2025, Lantern’s LDEI index, which measures the totality of the data, has risen 44.2 points from higher inflation, GDP, consumer spending, and industrial indicators; fairly broad-based (ex-housing). This movement has retraced more than half of what the LDEI had fallen from mid-February through mid-June. With how numbers are expected to be released over the next two weeks, the LDEI is expected to rise another 8 points transferring more ammunition from doves to hawks (see chart below).

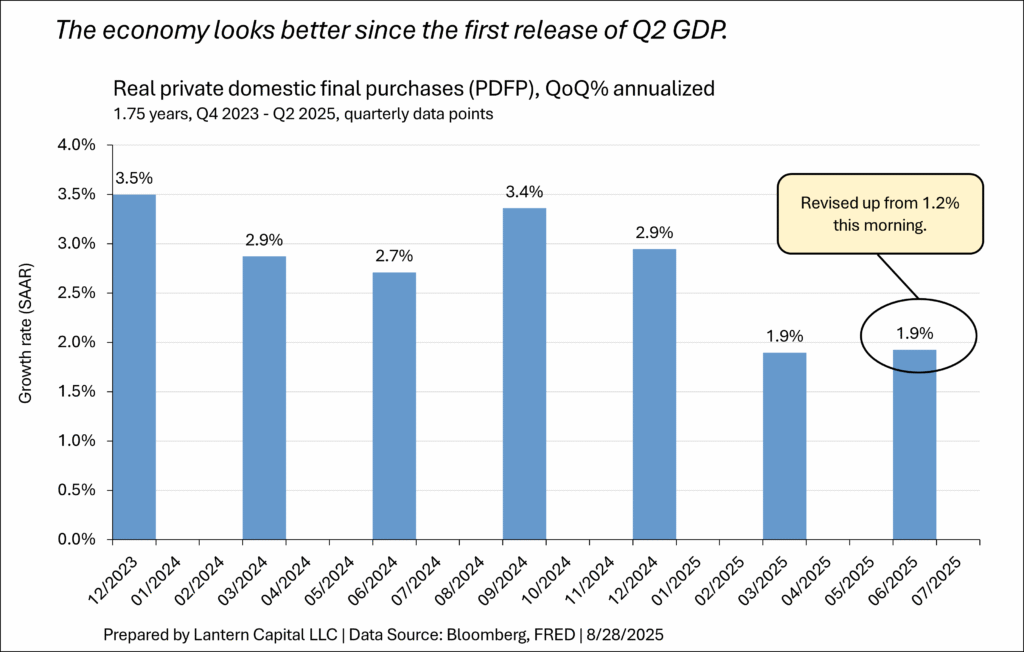

Also, in the second GDP revision released this morning, Core GDP, or Private Domestic Final Purchases, which excludes government spending, exports, and inventories and considered the underlying signal of demand in the GDP report by the Fed, rose from 1.2% to 1.9% which takes away some worry about GDP growth. The Fed considered first half growth to be about 1.5% before, but now it looks closer to 2% in this subset measure.

2. Because immigration has fallen this year, the Fed isn’t sure how many jobs are needed to keep the unemployment rate constant. Empirically, the 3-month average of jobs has fallen from 123k last July to 35k this July, all while the unemployment rate stayed at 4.2%, begging the question of “what will it take for the unemployment rate to rise?” Nearly all FOMC members (including Powell) are pointing to the unemployment rate as the “thing to watch” over payrolls because it answers the question of “are job losses exceeding the shrinking labor force?”. If the unemployment rate rises to just 4.3% next week as expected (from nearly 4.3% already, 4.248%) and payrolls come out materially positive (78k expected), I don’t think it will be enough to shake the hawks from their position.

3. Powell’s speech was widely seen as dovish, but as I wrote earlier this month, it found the middle. Powell was more dovish versus the last time he spoke at the July 30th FOMC press conference but compared to how dovishly the committee had shifted since the jobs report, it sounded neutral, balancing each dovish point with a hawkish one. Powell never said anything about cutting in September. In fact, no FOMC member has except for Waller this afternoon. They are waiting to see what August’s data looks like.

4. John Williams, President of the New York Fed, encapsulated the hawkish-leaning tone of the Fed in an interview with CNBC yesterday. Austan Goolsbee (Chicago), Beth Hammack (Cleveland), Alberto Musalem (St. Louis), Thomas Barkin (Richmond), Raphael Bostic (Atlanta), and Jeffrey Schmid (Kansas City) said similar things last week. An exchange with CNBC’s Steve Liesman,

Steve Liesman: We just put up a thing there John, a 84% probability of a cut in September, but I notice you’ve been dancing around giving me a date — the old joke in economics is give them a number, give them a date, but don’t give them both. Is September on the table for you?

John Williams: Well I definitely think that every meeting is from my perspective live. Again, we’re getting the risks more in balance and you’re just going to have to see how the data play out. I’m pretty optimistic about where the economy is. I think we are in a pretty good place in terms of keeping unemployment pretty low, in the low 4’s and having inflation come back down to 2% over the next two years, but we can get surprised, and we need to be driven by what’s the totality of the data.

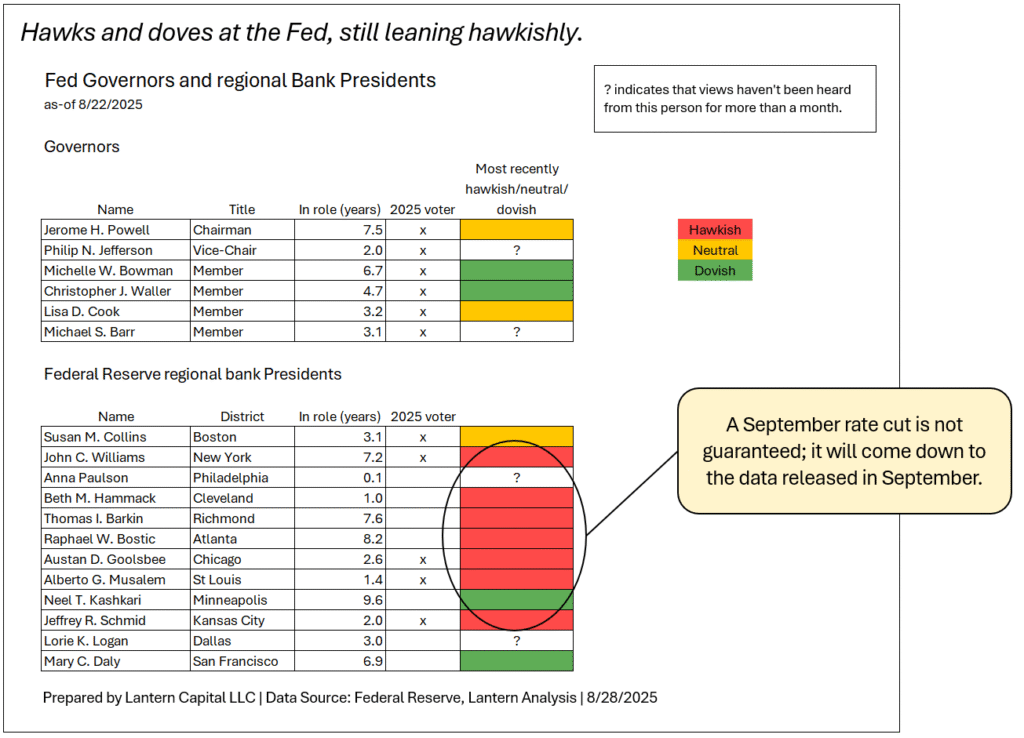

The balance of the Fed is still hawkish (table below) and despite categorizing Powell as neutral, he is just as nervous about inflation as any of them and if the economy holds up, I suspect he would take the opportunity to hold rates where they are to see more tariff inflation behavior. Eventually data will force them to lower (the business cycle moves in only one direction), but I’m not sure that happens before the next meeting on September 17th given the upward momentum of economic data. Economic data have come in 3-6 month waves for the last 2 years (first chart) and the index seems to inflect only once rates have risen to arrest the economy again. It has been just 2 months so far.

5. 5-year inflation expectations rose about 12 basis points this month (red circle) after the Fed started speaking dovishly and reached a 5-month high yesterday (blue arrow). Inflation expectations aren’t running away, but they’ve likely risen enough for the FOMC to take notice.

6. Truflation, a daily inflation measure which helps predict what inflation will be into the next month, has risen this month, suggesting August inflation will be hotter. The Bloomberg survey is for headline CPI to rise to +0.3% on 9/11/2025 from +0.2% the month before. Red oval in chart below.

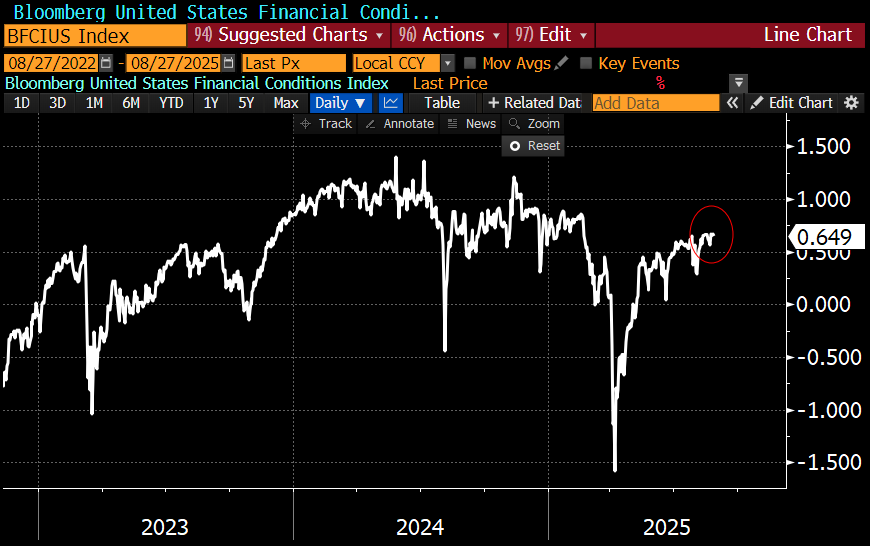

7. Bloomberg’s financial conditions index, largely a product of stock market levels and Treasury yields, is at a six-month high (higher is better), not indicating an economy needing a rate cut right away.

Doves Christopher Waller, Michelle Bowman, Mary Daly, and Neel Kashkari have the right idea to want lower rates because a recession is close and pre-emptive cutting would help, but because economic data has risen/gotten hotter in yet another wave, the fresh experience of 9% inflation in 2022 make it so many FOMC members aren’t ready to trust the cycle and let go of inflation fear. A September rate cut is entirely possible, but it needs cooler/weaker economic data to become consensus at the Fed.