Treasury yields will likely rise until weak data become prominent again

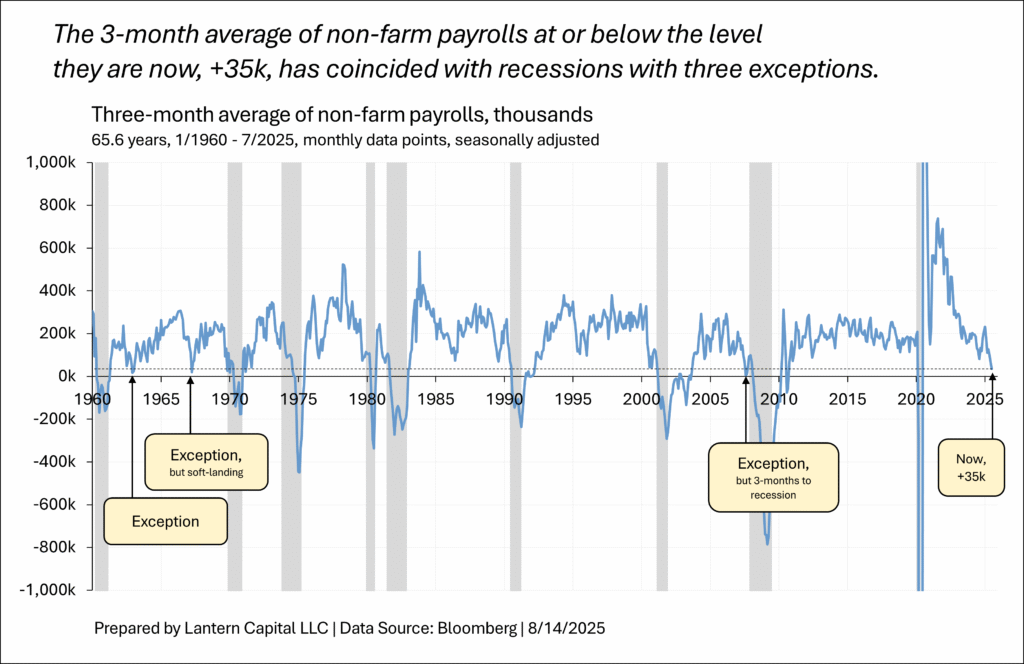

After the July payrolls report was released on August 1st, dovishness was in the air as regional Fed bank presidents Mary Daly and Neel Kashkari leapt to support the idea of near-term cuts because the labor market had weakened to a recessionary level (see chart below.) Governor Lisa Cook also indicated she was concerned about the labor market, saying in an 8/6 panel discussion,

We just received this jobs market report and this is concerning, you know, 35 thousand jobs per month over the last three months ending in July and there were major revisions, two major revisions to May and June and these revisions are somewhat typical of turning points.

Over the past weekend, Michelle Bowman, one of the “dovish-four” as I call them, re-affirmed her stance that the Fed should cut three times this year, highlighting economic weakness in a speech,

So far this year, consumer spending softened while residential investment declined, contributing to a much slower increase in private domestic final purchases compared to strong gains in 2024. Consumer spending on both goods and services has risen only modestly, reflecting slow gains in disposable personal income, lower levels of liquid savings, and high credit card utilization by lower-income households. Housing activity has declined, including in single-family home construction and sales, as listings of homes for sale are growing and house prices are falling, which suggests weakness in housing demand to a level last seen during the financial crisis.

The chart below summed up the feeling in the bond market; a recession might already be here.

The short-end of the yield curve rallied significantly (about 30 basis points in the 2-year), odds for a September cut rose from 42% to 100%, and odds for three cuts through the end of the year rose from 43% to 87%. It felt like the Fed was moving in one-direction: dovishly. But, this week, the hawkish side of the Fed re-asserted itself as economic data came in hotter,

On Tuesday, Tom Barkin, President of the Richmond Fed, downplayed inflation, but also downplayed the negativity of the payroll report. He said in a speech,

Job gains have slowed recently, which is certainly worth watching. But I’m hopeful that even as businesses face cost and price pressure, they’ll largely avoid the type of large layoffs that would spike unemployment and lead to consumer pullback. As with consumers, how businesses have come into this moment matters. Firms are already running lean. They’ve been slow-rolling hiring for years in anticipation of a recession that hasn’t come. They’ve been downsizing via attrition. With businesses already light on staff, we should see fewer reductions. So, any coming increase in the unemployment rate may well also be less than many anticipate.

Yesterday, Austan Goolsbee, President of the Chicago Fed, normally a dove, was characterized by the Financial Times in a press interview this way,

…Goolsbee told journalists on Wednesday afternoon that the US jobs market remained stronger than it appeared in the recent labour market data for July. He also said that some details in the inflation data had raised fears that the Fed’s efforts to stamp out price pressures were no longer on a “golden path”. While Goolsbee said he “definitely” did not want to tie his hands “prematurely” and commit to keeping borrowing costs on hold, he suggested that the central bank should remain vigilant. “If [high service price increases] persisted, we would have a hard time getting back to 2 per cent,” he said, referring to the Fed’s inflation target, as measured by Personal Consumption Expenditures.

And this morning, Alberto Musalem, President of the St. Louis Fed was interviewed on CNBC, suggesting that payroll numbers “sub-50” may be all that’s needed to keep the unemployment rate constant because of lower immigration,

Now, there are some signs of weakening. Payroll growth has been low, there were very large revisions as you know for the last two months of reported data. The story there is the demand for labor has declined, but so has the supply and that’s why looking at levels [payroll gains] may be less informative, that is levels of payrolls, than by looking at ratios [unemployment rate] and that’s why I’m looking at both at levels and at ratios. You may recall that last year, we had a break-even pace of employment that was north of 150, this year with lower immigration flows, it’s reasonable to expect that breakeven rate to be sub 50. And in fact, in spite of historic revisions, these were three standard deviation revisions which you should expect once every two to three decades—in spite of those revisions to the level of employment, the unemployment rate stayed unrevised which tells me that the supply of labor also declined, or cooled, let’s say that.

Whether these reasons to downplay the weak labor report are valid or not (I suspect not really), these FOMC members have become a formidable opposing force to the “dovish-four”. NY Fed bank president John Williams also called the labor market “solid” after the labor market report because the unemployment rate remained steady.

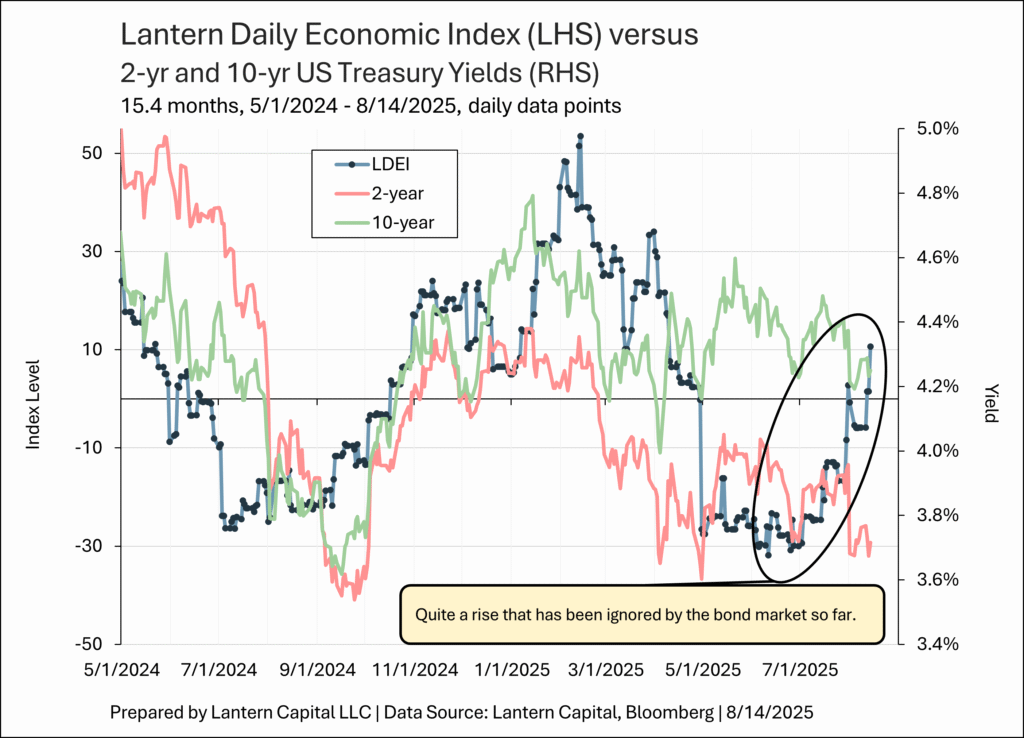

On the data side, the CPI report came in as expected on Tuesday, but core CPI rose by a tenth of one percent from the last report (to +0.3% from +0.2%, raising the LDEI) and core-services inflation, of which low numbers had been counter-acting tariff inflation, was high again this month (+0.5%). The PPI, which came out this morning, was +0.9% in the headline and core, coming from 0.0% in June and 4.5x higher than the +0.2% expected, raising the LDEI significantly. Overall, the LDEI has risen 16.5 points this week (through Thursday) to a new recent high and has now retraced a meaningful 50% of its fall from mid-February through the end of June (chart below). Headline retail sales is expected to come out tomorrow morning at +0.6% and will likely be the second consecutive month of strong gains, reducing the sense that the economy is in a recession. There won’t be new labor market data for three weeks to counteract this new more hawkish tone.

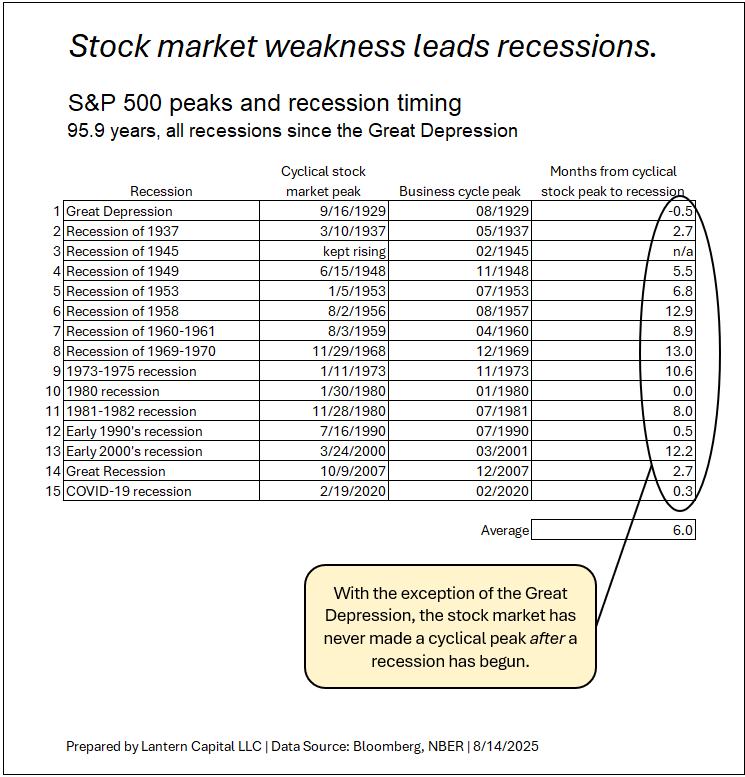

Also, historically, the stock market has reached a cyclical peak 6 months before recessions begin on average and no sooner than when recessions have begun (see table below.) Given that the stock market made a new all-time high today (and credit spreads are near lows), it is hard to argue a recession has already begun.

All these things: the Fed more hawkish, economic data better/hotter, no new important labor data for three weeks, and the economy likely not in a recession yet, add up to short-term pressure higher on Treasury yields. I think Treasury yields will rise and rate cut expectations will fall until weak economic data become prominent again (i.e., a weaker LDEI). Back on 8/6, I wrote,

Jerome Powell will make a speech at the Jackson Hole Fed conference later this month (21-23), and I expect him to make a pivot towards easing then.

Now, I doubt it. Powell has leaned hawkish of late and has new ammunition to remain that way. Hawks at the FOMC are still using any excuse that works to keep policy tight to make sure tariff inflation won’t run away on them. I don’t expect a back-up in yields to last long because the economy continues to weaken and the next shoe to drop can’t be far-off, but it feels like the dovish narrative of the last two weeks has reached its saturation point.