Don’t fall for the Q2 growth mirage

Stock bulls have something of a mantra now, “the recession is cancelled” from forecasts of GDP to rise significantly in Q2, tariffs coming down, and the Fed’s characterization of the economy as “solid.” These three pillars have reinforced each other to create an optimistic narrative bigger than the sum of its parts. The second pillar of tariffs coming down has been torn up in recent days and the third pillar of the “solid” economy was always an overstatement to defend why the Fed is not cutting rates.

But this post is about the first pillar, because it underpins the other two and is misunderstood. Q2 GDP will almost certainly improve from Q1 (-0.5%) when it is released later this month (7/30, see forecasts below), but this is because GDP was understated in Q1 from heavy import activity ahead of tariffs.

Q2 GDP forecasts:

-Atlanta Fed GDPNow: +2.6%

-Bloomberg economists survey: +2.1%

-NY Fed: +1.6%

-St. Louis Fed: +1.4%

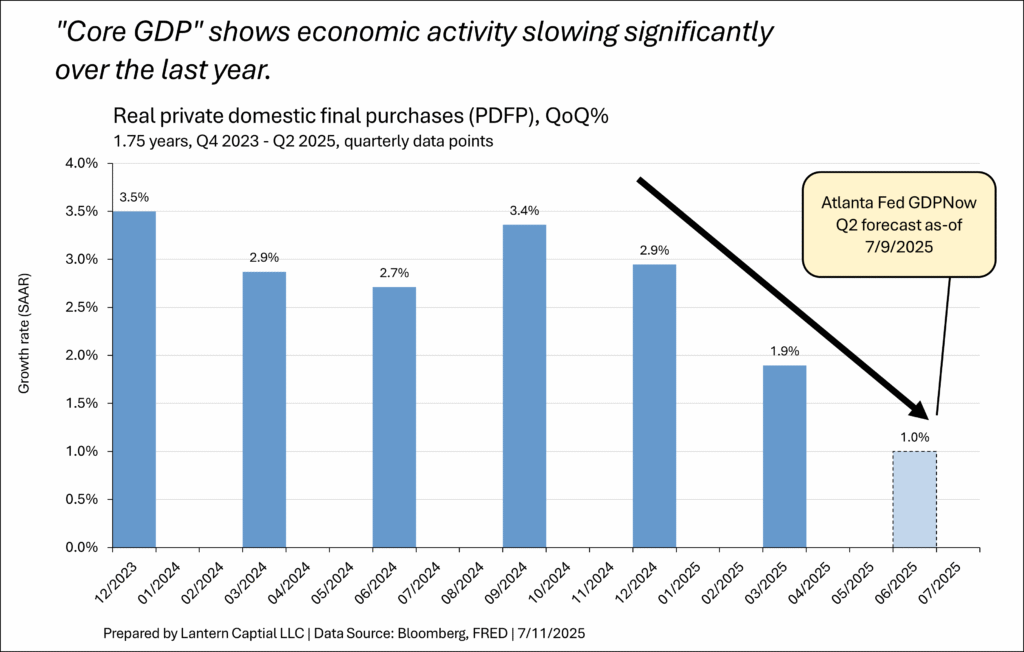

In FOMC meeting press conferences, Jerome Powell frequently mentions that the Fed looks at a subset measure of GDP called private domestic final purchases (PDFP) for a more reliable signal of demand within the GDP report. Think of PDFP as “core GDP” in the metaphor of core CPI; the underlying signal. Positive PDFP was important to seeing that there wasn’t a recession back in 2022; when Q1 and Q2 GDP were negative consecutively and it has a closer relationship to the six monthly recession indicators the NBER uses to date recessions. In the last FOMC press conference, Jerome Powell explained that PDFP is what “solid” is based on,

Following growth of 2.5 percent last year, GDP was reported to have edged down in the first quarter, reflecting swings in net exports that were driven by businesses bringing in imports ahead of potential tariffs. This unusual swing has complicated GDP measurement. Private domestic final purchases, or PDFP, as we call them—which excludes net exports, inventory investment, and government spending—grew at a solid 2.5 percent rate.

For Q1, PDFP was 2.8% in the first release, then was revised down to 2.5% in the second release (as-in the quote above) and is now 1.9% in the third release; a steady reduction in how “solid” the economy looks. Components from the Atlanta Fed’s GDPNow contain a forecast for upcoming PDFP. As of Wednesday, their nowcast for this figure in Q2 is just 1.0%, which would be the lowest number since Q4 of 2022 and the third consecutive lower quarter showing that the underlying trend of economic activity is slowing, not improving (see chart below).

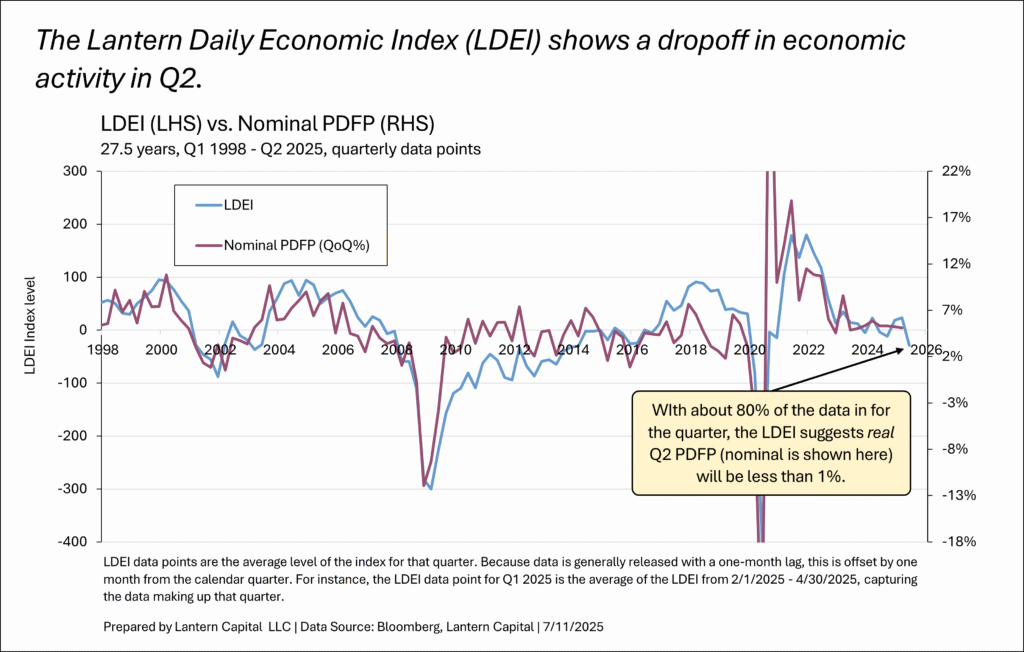

PDFP helps reconcile the large downturn in the Lantern Daily Economic Index (and other monthly composite indicators such as the Conference Board’s Coincident Indicators Index or S&P monthly GDP) over the last few months. The LDEI is well correlated to nominal PDFP (chart below). With about 80% of the economic data released for the second quarter, the LDEI suggests PDFP will be less than 1%.

Several things have conspired over the last few months to create the illusion that there is “nothing to see here” about the economy, but the economy is indeed weakening and there are just too many signs of recession to think one won’t come. I continue to think one will begin the next few months.